Salesforce Financial Cloud Implementation Guide 2025

In 2025, financial institutions are at a crossroads. Client expectations are evolving rapidly, with personalized digital experiences becoming the norm. Yet despite the surge in digital touchpoints, 81% of banking clients still prefer having a human relationship manager to guide financial decisions.

The challenge? Bridging the gap between digital convenience and personal trust.

According to Salesforce’s Connected Financial Services Report 2025, only 49% of customers say they’re fully satisfied with their bank’s service. To close this gap, 84% of advisory firms are investing heavily in digital tools to enhance both experience and efficiency. Central to this digital push is the CRM system, with 92% of financial services executives considering it a board-level priority.

That’s where Salesforce Financial Services Cloud (FSC) leads the charge.

Why FSC?

Built specifically for banking, insurance, and wealth management, FSC unlocks customer data from siloed systems and presents it as a unified, 360-degree view of each client. It’s packed with industry-specific tools—like the Actionable Relationship Center (ARC), householding, Action Plans, and built-in compliance tracking—that enable firms to deliver personalized, scalable experiences at speed.

As Eran Agrios, SVP & GM of Financial Services at Salesforce, puts it:

“Firms can now leverage digital labor built on a deeply unified platform to help their human teams boost productivity, efficiency, and revenue, while delivering the trusted and personalized experiences their clients want.”

This guide walks you through a proven, step-by-step framework for implementing Salesforce FSC successfully in 2025, backed by real-world examples like RBC Wealth Management, which utilized FSC to reduce advisor prep time by hours and provide instant access to critical client data. Let’s get started!

Step 1: Planning and Strategy

A successful FSC rollout begins with sharp planning. According to various industry studies, 30–70% of CRM projects fail, often due to poor planning or lack of clear business alignment.

🔹 Define Your “Why”

Start by identifying your goals. For example:

- Wealth Management: “Increase client retention by 15% by unifying relationship data.”

- Retail Banking: “Reduce onboarding time by 30% using automated checklists.”

- Call Centers: “Improve first-call resolution by 20% via unified customer profiles.”

Translate each goal into specific KPIs that can be tracked post-launch.

🔹 Secure Executive Sponsorship

An executive champion (or steering committee) ensures funding, clears roadblocks, and helps drive adoption. Create a cross-functional governance team including:

- Business heads

- IT and CRM leaders

- Risk/compliance officers

- Front-line advisors or RMs

This group owns alignment, communication, and benefits tracking.

🔹 Conduct a Readiness Assessment

Document your current tech stack, identify legacy CRMs, and evaluate data sources (core banking systems, Excel files, legacy portals). Gauge user readiness and training needs.

Don’t skip stakeholder interviews—this is where real pain points (and change resistance) are surfaced.

🔹 Define Scope and Phases

Avoid boiling the ocean. Common phasing strategies include:

Strategy | Example |

By Business Line | Start with retail banking, then expand to wealth and insurance. |

By Function | Start with customer 360 & service; later add marketing, analytics, and portals. |

Keep major phases to 3–6 months for rapid wins.

🔹 Budget and Resources

Include:

- Salesforce licenses (FSC, Shield, Einstein, etc.)

- Internal team hours

- Partner/consultant fees

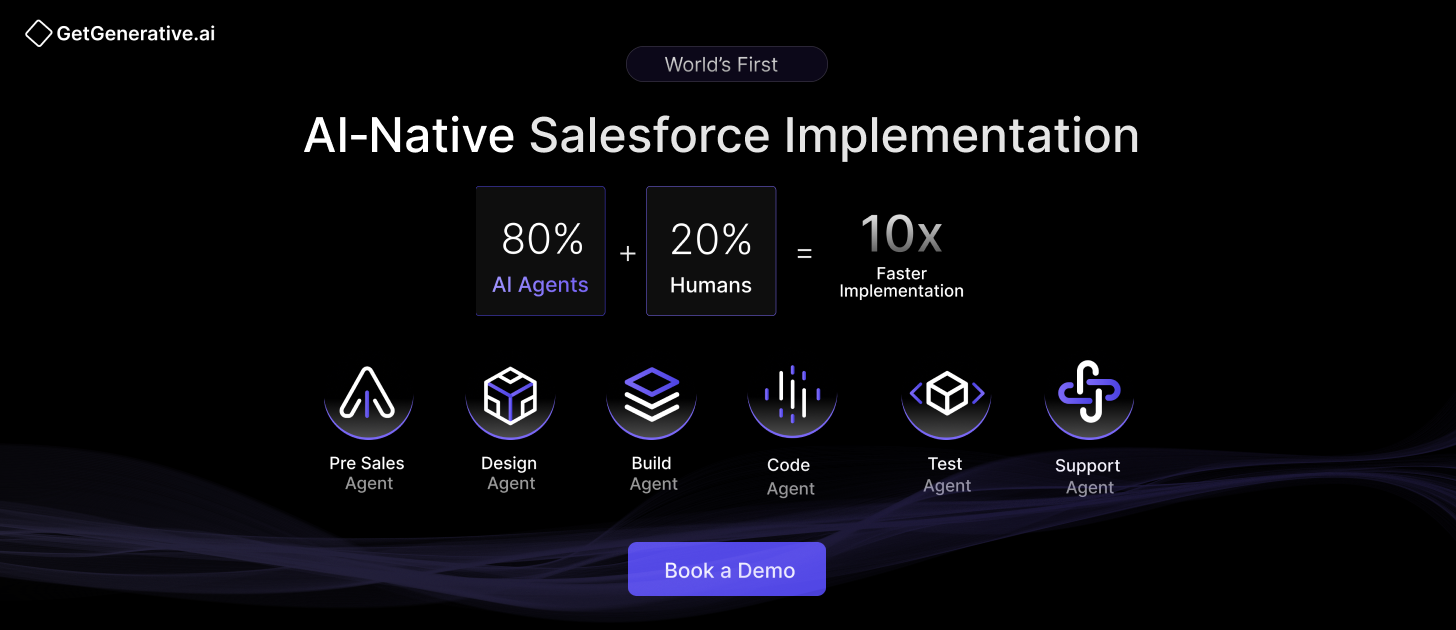

Many firms choose partners like Deloitte or Accenture, or specialized Salesforce consulting partners like GetGenerative.ai, which offer accelerators and AI tools to cut timelines and costs.

🔹 Org Strategy: Existing vs New?

Option | Pros | Cons |

Install FSC in existing org | Reuses data, customizations | Higher risk of conflicts, complex integration |

New org with FSC | Clean slate, clean config | Data migration required, duplicate logic rebuild |

Perform an Org Fit Assessment and get expert help if needed.

Also Read – Key Features of Salesforce Financial Services Cloud

Step 2: Solution Design and Architecture

Design is where strategy meets structure.

🔹 Run Requirements Workshops

Engage users and business leaders to gather:

- Customer workflows

- KYC and compliance steps

- Data access needs

- Reporting expectations

Use user stories like:

“As a wealth advisor, I want to see a client’s full portfolio (including held-away assets), so I can offer personalized investment suggestions.”

🔹 Design Your Data Model

- Use Person Accounts for individuals (auto-enabled in FSC)

- Use Business Accounts + Contacts for B2B

- Leverage Households to group families or business entities

Map existing fields from your core systems into standard FSC objects where possible.

🔹 Design for Integration

Common integrations include:

- Core Banking (balances, transactions)

- Loan Origination (LOS)

- Investment Portfolios

- KYC/AML systems

- External fintechs (e.g. nCino, Experian)

Use MuleSoft, Salesforce APIs, or native connectors.

Build diagrams that show:

- Data ownership (source systems)

- Real-time vs batch sync

- API authentication models

🔹 Plan Security and Compliance

Use Salesforce’s layered security model:

- Profiles & Permission Sets: FSC ships with role-specific sets like “Financial Advisor,” “Insurance Agent”

- Sharing Rules: Determine visibility by role, geography, or team

- Shield Encryption: For PII, account numbers, and regulatory data

- Audit Trails & Field History: Required for FINRA, GDPR, and other audits

Ensure regulatory walls (e.g., between Retail and Investment) are respected.

🔹 Analytics and Reporting

Identify key dashboards like:

- Advisor pipeline performance

- Household AUM (Assets Under Management)

- Referral conversions

- SLA performance on service cases

Leverage Einstein for FSC (Tableau CRM) templates and customize as needed.

Step 3: Configuration and Customization

Once your design is finalized, it’s time to configure Salesforce FSC according to your blueprint.

🔹 Environment Setup

Set up the following orgs:

- Dev Sandbox for component-level configuration

- Partial or Full Copy Sandbox for UAT and data testing

- Production Org (new or existing) with Financial Services Cloud licenses

🔹 Permissions and Role Setup

FSC uses Permission Sets and Permission Set Groups rather than relying solely on Profiles.

Assign roles like:

- Personal Banker

- Wealth Advisor

- Insurance Agent

…based on business functions. Grant access only to relevant objects (e.g., Financial Account, Goal, Action Plan).

Implement Role Hierarchy for data access by team or geography. For example, branch managers can see all RMs in their region.

🔹 Page Layouts and Lightning Pages

Design Lightning Pages with relevant widgets and tabs:

- Client Snapshot Component

- Financial Account Summary

- Action Plan Tasks

- ARC (Actionable Relationship Center)

Use Dynamic Forms to show/hide fields based on criteria (e.g., client type, stage, or product).

Example: Use a tabbed layout to separate Retail and Wealth views on the same client record.

🔹 Enable FSC Features

Feature | Setup |

ARC (Relationship Map) | Enable via Setup, assign permissions, customize relationship types |

Action Plans | Create task templates for onboarding, loan processing, KYC checks |

Householding | Enable groups, configure roll-ups for AUM, referrals, cases |

Roll-Up Summaries | Configure to display Total Assets, Loan Balances, and Insurance Coverage |

Analytics Dashboards | Deploy Tableau CRM templates and adjust for your org’s KPIs |

🔹 Salesforce Flows and Automation

Use Flow Builder for:

- Auto-creating Action Plans when a new Financial Account is opened

- Triggering alerts on high-value deposits

- Assigning onboarding tasks upon opportunity close

Use declarative automation where possible. Use Apex only for:

- Complex validations

- Advanced roll-ups

- Custom APIs

Step 4: Data Migration and Integration

🔹 Define Your Data Migration Scope

Migrate the following:

- Clients and households

- Financial accounts (banking, loans, policies, investments)

- Opportunities and referrals

- Service requests

- Historical interactions (if valuable)

Use Data Loader for small volumes, or ETL tools like Informatica, Talend, or MuleSoft for large-scale migration.

🔹 Data Mapping and Cleansing

- Map legacy fields to FSC standard objects

- Standardize field values (e.g., state names, currency)

- Clean duplicates using matching rules

- Apply formatting standards (email, phone, SSN)

🔹 Cut-Over Plan

- Set migration cut-off (e.g., Friday 5 PM)

- Freeze legacy systems

- Run delta load post-cut-off

- Validate counts and spot-check records post-load

Keep archived legacy data accessible via reports or external repositories.

🔹 Integration Execution

Go live with:

- Real-time APIs (e.g., for KYC status, payment updates)

- Batch syncs (e.g., nightly balance updates)

- External apps (e.g., credit checks, document storage)

Secure connections via OAuth 2.0, TLS, and firewalls. Ensure audit logs are available for compliance review.

Step 5: Testing and Quality Assurance

🔹 Unit Testing

- Validate each Flow, Action Plan, record type, and permission set

- Test Apex classes for bulk safety and governor limits

- Aim for 90%+ code coverage

🔹 System Integration Testing (SIT)

Simulate full workflows:

- Loan request via referral → LOS update → Status return to FSC

- Change in address → Update core banking and CRM

- KYC completion → Trigger Action Plan completion

🔹 User Acceptance Testing (UAT)

Engage real users in scripts like:

- “Create a new household and add financial accounts”

- “Log a service request and assign follow-up tasks”

- “Track goals for a high-net-worth client”

Capture feedback, fix issues, and re-test before go-live.

Related Read – Salesforce UAT Best Practices for Smooth Go-Live

🔹 Performance and Regression Testing

- Run API loads with tools like JMeter

- Test record creation at scale (e.g., 50K financial accounts)

- Validate dashboard load times and report refresh

Step 6: Training and Change Management

🔹 Role-Specific Training

Create tracks for:

- Retail Bankers

- Wealth Advisors

- Back Office/Operations

- IT Support

- Compliance Officers

Use:

- Hands-on sessions with real use cases

- myTrailhead modules for scalable self-paced learning

- 1-pagers and cheat sheets for top 10 tasks

- In-app prompts using Salesforce In-App Guidance

🔹 Build Adoption with “What’s in it for Me?”

Tie features to benefits:

- “No more switching systems—your client’s banking and investment profile is on one screen.”

- “Onboarding tasks auto-assign, saving 30 minutes per client.”

Gamify adoption with dashboards showing completed tasks or top FSC users.

🔹 Communication Cadence

- Countdown emails: T-minus 30, 15, 5 days

- Leadership videos: “Why this matters for our future”

- Live Q&A: Office hours in Week 1 and 2

- Feedback forms: Pulse surveys post-go-live

Also Read – Reinventing Salesforce Implementation with the AI Native Delivery Framework

Step 7: Deployment and Post-Go-Live Support

🔹 Go-Live Checklist

- Final deployment (via change sets or CI/CD tools)

- Enable all integrations in production

- Assign licenses and permission sets

- Final data validation (record counts, household links)

Run smoke tests immediately post-deployment.

🔹 Hypercare and Early Support

- Daily standups during first 2 weeks

- On-call support for technical or access issues

- Rapid response for high-priority bugs

Create a Known Issues log and communicate resolutions.

🔹 Usage Monitoring

Track:

- Logins by user

- Tasks completed

- New records created (Accounts, Financial Accounts)

- Action Plan usage

- Dashboard engagement

🔹 Continuous Improvement

Form a Salesforce Governance Council or Center of Excellence (CoE).

Maintain:

- Product roadmap

- Enhancement backlog

- Quarterly improvement sprints

- Feedback loops from end users

Plan Phase 2 rollouts (e.g., agent chatbots, Experience Cloud portals).

🔹 Success Measurement

Return to the KPIs from planning:

KPI | Pre-FSC | Post-FSC | Uplift |

Avg onboarding time | 14 days | 9 days | 35% faster |

Client meeting prep time | 3 hrs | 45 min | 75% reduction |

Cross-sell ratio | 1.3 | 2 | 0.54 |

Celebrate wins internally and externally (e.g., PR, Salesforce customer success stories).

Related Read – Salesforce CRM Implementation With AI – The Ultimate Guide

What are the security features of Salesforce Financial Cloud?

Salesforce Financial Cloud prioritizes data security and privacy:

- Multi-factor authentication: Enforce strong authentication measures to protect user accounts.

- Role-based access control: Define granular access permissions based on user roles and responsibilities.

- Data encryption: Encrypt sensitive data both at rest and in transit.

- Compliance certifications: Salesforce Financial Cloud complies with industry standards like ISO 27001, SOC 1, and SOC 2.

What are the key features of Salesforce Financial Cloud that enhance financial data management?

Salesforce Financial Cloud offers several features to streamline financial data management:

- Client profiles: Maintain comprehensive client profiles with financial goals, risk tolerance, and investment preferences.

- Wealth management tools: Access a range of tools for portfolio management, financial planning, and investment analysis.

- Relationship intelligence: Gain insights into client relationships and identify opportunities for cross-selling and upselling.

- Data analytics: Leverage built-in analytics to derive actionable insights from financial data.

Conclusion

The most successful financial institutions in 2025 are those delivering hyper-personalized, AI-enhanced, trust-based client experiences. Salesforce Financial Services Cloud enables exactly that—if implemented strategically.

Curious how this could work in your organization?

GetGenerative.ai offers an AI-native workspace to plan, scope, and manage Salesforce FSC implementations—start to finish.

If you’re looking for help with Salesforce implementation, explore our AI Salesforce Consulting Services for expert guidance tailored to your business.

See it in action. Book a demo today!

FAQs

1. How long does it typically take to implement Salesforce Financial Cloud?

The implementation timeline varies depending on the complexity of your requirements and the size of your organization. It can take anywhere from a few weeks to several months.

2. Can Salesforce Financial Cloud be customized to meet our specific needs?

Yes, Salesforce Financial Cloud is highly customizable. You can tailor the solution to your unique business processes, branding, and requirements.

3. Is data migration from our existing systems to Salesforce Financial Cloud possible?

Absolutely. Salesforce provides robust data migration tools and services to ensure a smooth transition of your existing data into Salesforce Financial Cloud.

4. What training is required for our team to use Salesforce Financial Cloud effectively?

Salesforce offers a range of training options, including online courses, webinars, and in-person training sessions. Your implementation partner can also provide customized training tailored to your specific needs.

5. How does Salesforce ensure the security and privacy of our financial data?

Salesforce employs industry-leading security measures, including multi-factor authentication, data encryption, and regular security audits. Salesforce Financial Cloud is built on a trusted platform compliant with stringent security standards.